Published on 20 December 2024

Cleantech is at a pivotal point.

On the one hand, we’ve seen the political agendas seemingly turning their back on cleantech companies. The future US government explicitly favours geopolitical and economic topics and at times even overtly backs dirty technologies.

Fuelled by a world wrapped up in global conflict, cleantech stocks have been under pressure in the past 2 years.

On the other hand, cleantech has come a long way. In many places clean energy technologies are already the cheapest way to generate power. Electric cars are mainstream. And many clean technologies have a clear business case.

Today we’re going to shed light on the state of cleantech and what it means as an investment opportunity:

- How did we get here?

- Where are we now?

- What happens next?

What’s cleantech?

Cleantech, short for clean technology, refers to a broad range of products and services that leverage innovative technologies to reduce environmental impact, increase resource efficiency, and promote sustainability. Examples of cleantech industries are clean energy, sustainable transportation, circular economy, and water and waste management.

How did we get here? A review of the last 7 years.

Over the past seven years, cleantech has experienced two distinct phases:

1. 2018–2021: The Boom

Between 2018 and 2021, cleantech stocks soared, thanks to:

- Supportive government policies and increasing commitments to sustainable infrastructure.

- Ultra-low interest rates that made green investments more accessible.

- A dramatic drop in solar manufacturing costs, making renewables more competitive – a massive boost for clean energy stocks.

Even the outbreak of the COVID-19 pandemic didn’t slow this momentum. Governments doubled down on green recovery plans, and cleantech stocks more than doubled between March 2020 and February 2021.

2. 2021–2024: Cleantech under pressure

But as COVID-19 persisted, new challenges emerged: global supply chains were disrupted, and economic slowdowns hampered growth in certain areas.

Soon after, the geopolitical landscape shifted with the Ukraine crisis, causing further disruptions in global energy markets.

Several key challenges emerged during this period:

- Rising interest rates, increasing the cost of financing for green projects.

- Aging grid infrastructure unable to keep pace with the rapid growth in renewable energy production.

- Intensifying competition from low-cost renewable energy companies in Asia, creating pricing pressures.

As a result, clean energy stocks came under significant pressure, with ripple effects spreading across the broader cleantech sector.

At the same time, some sectors, most notably big tech, oil, and defense, thrived. This contributed to broader market indices reaching new heights, whilst the cleantech sector faced hurdles.

Where are we now? A look at financial performance.

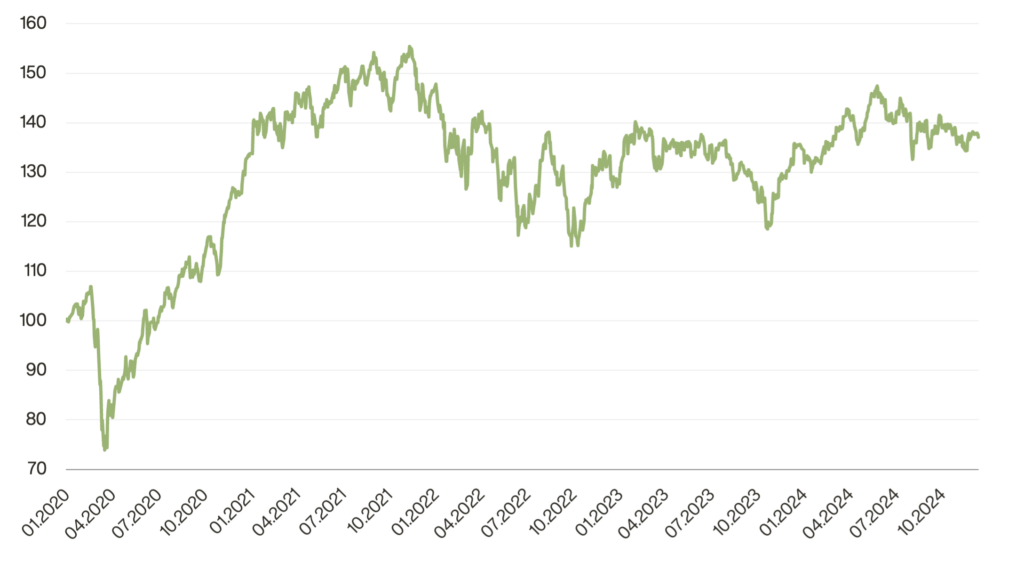

1. Average performance of Inyova portfolios since January 2020

Over the past five years, the average Swiss Inyova portfolio with 100% stock split delivered a robust annual return of 6.6% after fees.

It thereby mirrored the growth potential and volatility of cleantech investments: it achieved exceptional returns during the boom period through the end of 2022 but faced challenges of the cleantech sector thereafter.

2. Comparing the average Inyova portfolio to broad market indices and benchmarks

Over the past five years, the average Swiss Inyova portfolio with 100% stock split (green line) has held up well compared to broad market indices. It considerably outperformed the Swiss Performance Index (blue line) by 2.6% after fees per year.

The S&P 500 index (yellow line) stands as a clear outlier, driven largely by the extraordinary growth of big tech stocks like Apple and Amazon.

The strong performance of the S&P 500 is a key reason why the average Inyova portfolio falls short when compared to its current benchmark (red line). This benchmark combines the performance of several indices, with around 25% coming from the S&P 500.

We understand that the current benchmark may not provide the most relevant comparison for Inyova portfolios. That’s why we’re working to improve performance comparisons in the Inyova app and will introduce updates soon.

What’s next? Outlook for cleantech

The cleantech sector may face some short-term challenges. Trade policies and budget concerns have created uncertainty in some regions, and not all governments are sticking to their net-zero targets.

Still, the long-term outlook remains highly promising: valuations of cleantech companies have come down to levels last seen in 2020. Investing in cleantech is more affordable than it has been in years. If you believe in the market’s potential, now may be the time to invest.

Take clean energy stocks as a prime example:

- The global solar market is projected to grow by 20-30% annually in the upcoming years.

- Solar and wind energy are now cheaper than fossil fuels in many regions, creating a growth opportunity outside government subsidies.

- Electricity demand is rising quickly, fueled by continued global electrification and advancements like A.I.

To meet this demand, the world needs more renewable energy, better energy storage, and upgrades to old power grids. These changes are already underway and will drive the clean energy industry forward.

Cleantech is the future – not just because it’s good for the planet, but because it makes sense for the economy. It’s an exciting time to invest in solutions that solve real problems and shape a more sustainable world.

Why We Keep a Long-Term View

At Inyova, we continue to strongly believe in the long-term investment thesis for cleantech: Companies that help reduce our reliance on finite resources are positioned to thrive in the decades to come.

With the world consuming two planets worth of resources every year, issues like extreme weather and resource shortages will only get worse. Companies offering differentiated and sustainable solutions will be best positioned to weather these storms and drive long-term growth.

What We’re Doing Together Matters

Your investment in cleantech does more than just fuel financial returns. It’s a statement that you believe in a better future. With your support, you are helping to shape a sustainable future:

- By investing in companies that are well-positioned for long-term success as the world transitions to sustainable energy.

- By joining 8,000 other Inyova impact investors who are actively pioneering change and influencing companies to perform better for the planet.

What you can do

The cleantech sector offers exciting opportunities for investors who care about long-term sustainability. Advancements in technology and growing demand make this sector a cornerstone of the future economy. By investing now, you’re seizing the current investment opportunity and help shape a greener, brighter future.

We’re excited about the opportunities ahead and are committed to helping you make a difference while achieving your investment goals.

Thank you for being part of the change.

Reach out for support

If you have any questions about your portfolio, our Customer Success team is happy to help you. You can email us at [email protected] or call +49 69 120 01237.

Sources:

Advertising notice: The information and evaluations presented here are an advertising announcement which has not been prepared in accordance with legal provisions promoting the independence of financial analyses and is not subject to any prohibition of trading following the dissemination of financial analyses. The acquisition of this investment involves considerable risks and may lead to the complete loss of the invested assets. Inyova receives an all-inclusive fee of 0.9 - 1.2 & p.a. for its services, depending on the amount of assets under management. The exact calculation can be found at www.inyova.de/en/fees.

Risk notice: All information is only intended to support your independent investment decision and does not represent a recommendation by Inyova. The product information and calculation examples presented do not claim to be complete or correct. Only the specifications in the asset management contract incl. the further legal documents, which are made available to customers of Inyova via the complete customer documentation, are authoritative. Please read the asset management contract and the other client documents carefully before making an investment decision. The following applies to all shares and ETFs: Past performance is no guarantee of future performance. Information on past performance does not permit forecasts for the future. Investments in securities include the risk of a loss in value. Other securities services may achieve different results. The results for individually managed portfolios as well as the different time full stops may differ due to market conditions, different entry times, different portfolio sizes, individual restrictions and the respective composition of the portfolio.

Disclaimer: Past performance of financial markets and instruments is never an indicator of future performance. The statements or information contained in this document do not constitute a recommendation, offer, or solicitation to buy or sell any security or financial instrument. Inyova GmbH assumes no liability whatsoever with regard to the reliability and completeness of the information contained in this article. Liability claims regarding damage caused by the use of any information provided, including any kind of information which is incomplete or incorrect, will therefore be rejected. Furthermore, the statements contained in this document reflect an assessment at the time of publication and are subject to change. References and links to third party websites are outside the responsibility of Inyova GmbH. Any responsibility for such websites is declined.

EU Sustainable Finance Regulation: the terms and categories from this post do not correspond to the terms and categories of the EU Sustainable Finance Regulation. You can find the disclosures and explanations required under the EU Sustainable Finance Regulation at https://inyovagmbhpro.wpenginepowered.com/en/sustainable-finance-disclosure-regulation..