Inyova Reviews: What Do Customers Say About Inyova?

UPDATE: The Inyova app is now live. It’s available in the App Store and on Google Play — click through to see more reviews from our impact investing community.

At Inyova, our customers are at the core of what we do. They’re the ones selecting their individual investment themes, shaping their investment experience with Inyova, and most importantly — changing the world through impact investing.

Customer satisfaction is our number one priority, and we put a lot of effort into providing an incredible and seamless impact investing experience.

This is why we regularly ask our customers to share their perspective on what’s working well, what improvements they would like to see, and their overall satisfaction with our technology, our investing expertise, and our customer service.

In this article, we’ll summarise the most common feedback we receive from our customers and how we react to it.

What is Inyova and how does it work?

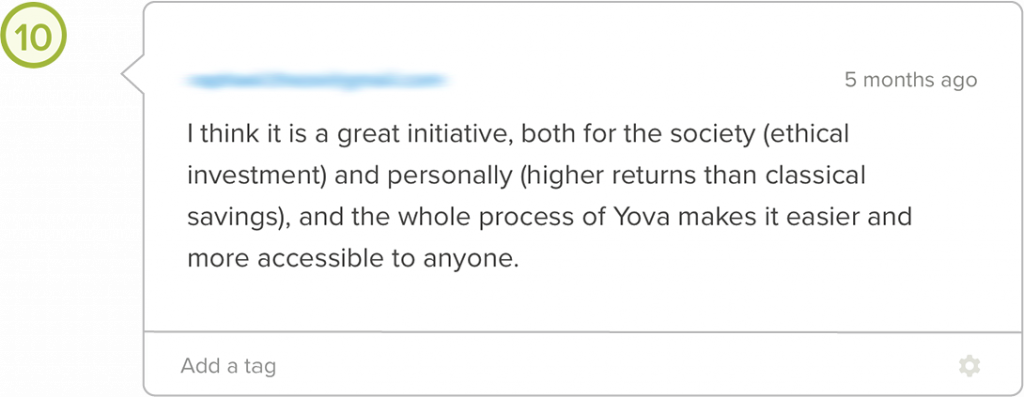

To provide a bit of context on what we do, Inyova is a digital investment platform that helps you to have a positive impact on the environment and society while growing your wealth in the long-term. We help customers achieve their financial goals by investing their savings in a way that matches their values and lifestyle (think electromobility, plant-based food, and gender equality).

Research shows that people, particularly younger generations like Millennials and Gen Z, want to support companies that share their values. Still, they don’t necessarily know how to take the first step and most investment options, like robo advisors, retail banks, and online DIY brokers, don’t inspire them to take action.

In contrast to more traditional alternatives, Inyova is an innovative approach backed by proprietary software, where we make impact investing simple for you. The whole process is fully personalised, transparent, and easy. There’s no more second-guessing about how to choose the right companies to invest in!

How does Inyova rank in customer reviews?

As we continue to grow and reach more diverse customers of different age and income levels, we value our reputation and customer satisfaction. After all, our mission is to make impact investing mainstream – and for that, we need to provide a service that inspires customers to tell all their friends, family, and colleagues about us!

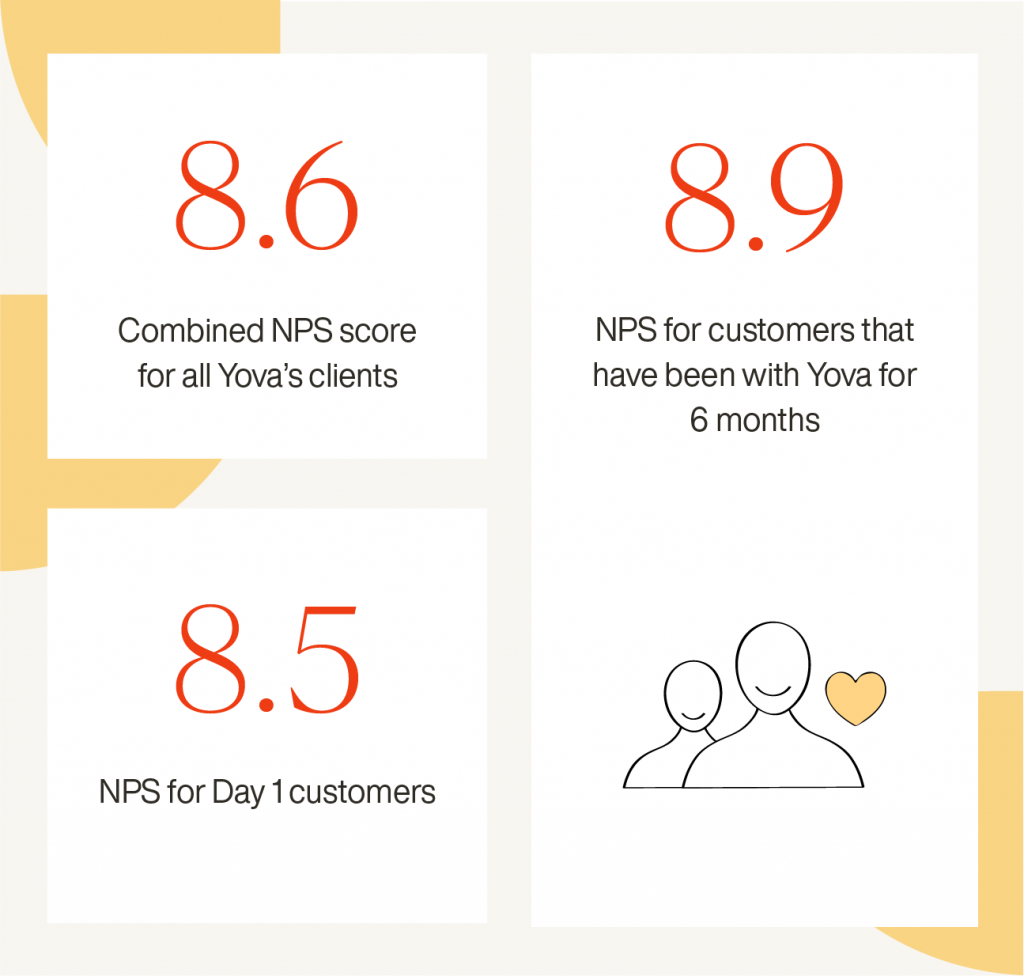

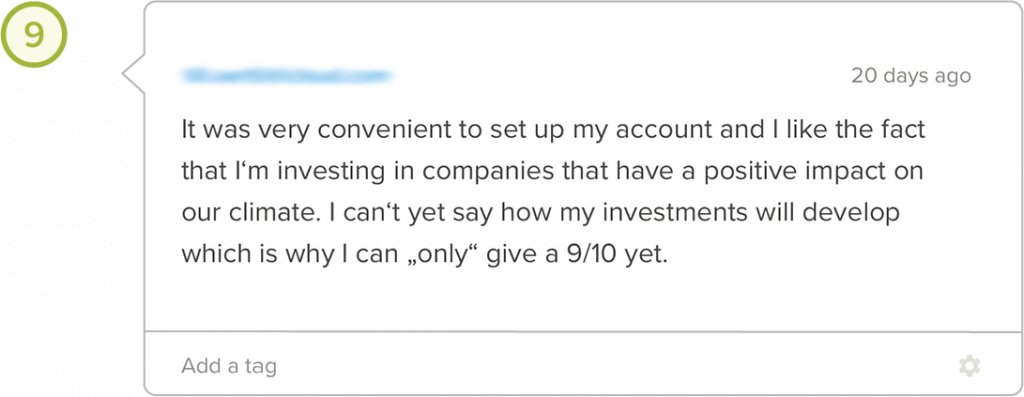

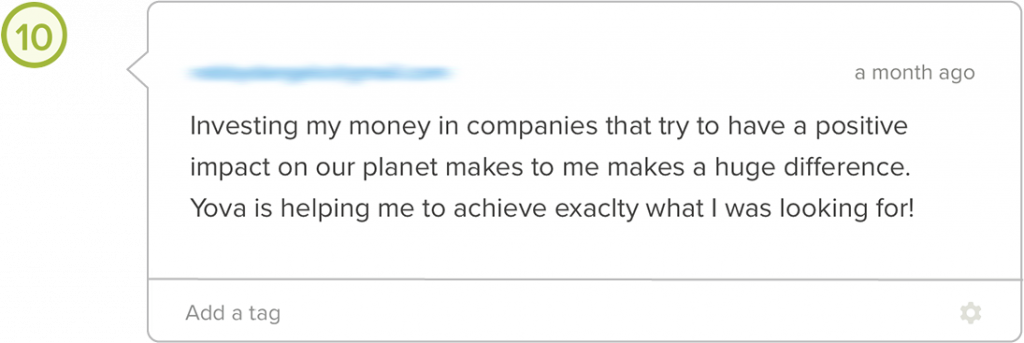

To better understand our client experience and help us improve, we ask each Inyova customer to rate how likely they are to recommend Inyova to a friend on a scale of 0 to 10. The process is repeated at different stages of a customer’s journey. Based on the answers, we calculate a Net Promoter Score (NPS).

As of January 2020, our combined NPS score for all Inyova’s clients is 8.6. Here’s the exciting part: satisfaction increases the longer a client works with Inyova. The average score for Day 1 customers was 8.5, while the average rating for users who have invested with Inyova for over six months was 8.9. This shows that customers like what we’re doing and want to keep growing their portfolios with us!

What do customers like about Inyova?

It’s clear that customers enjoy their overall Inyova experience more and more over time. But what makes impact investing with Inyova so special?

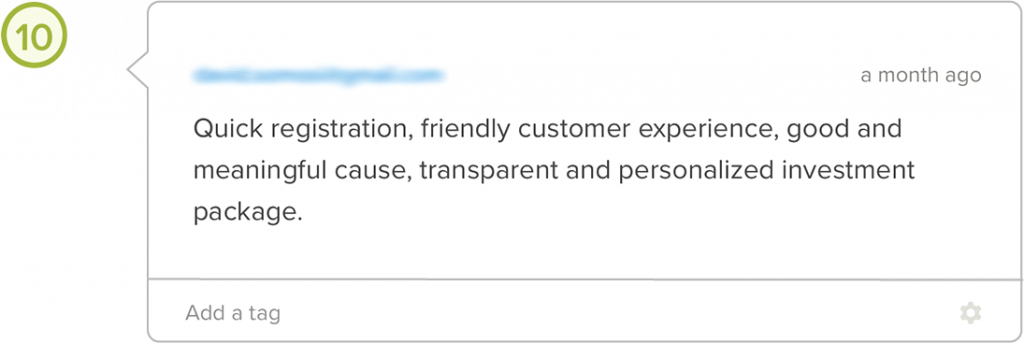

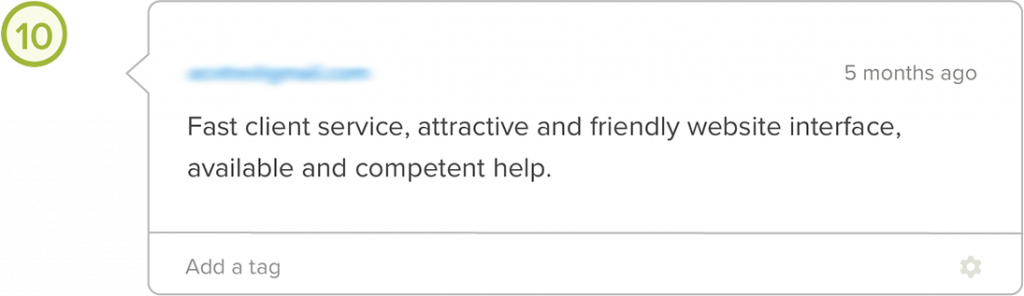

In yova.ch reviews, there are a few key trends that differentiate us from other players in the market:

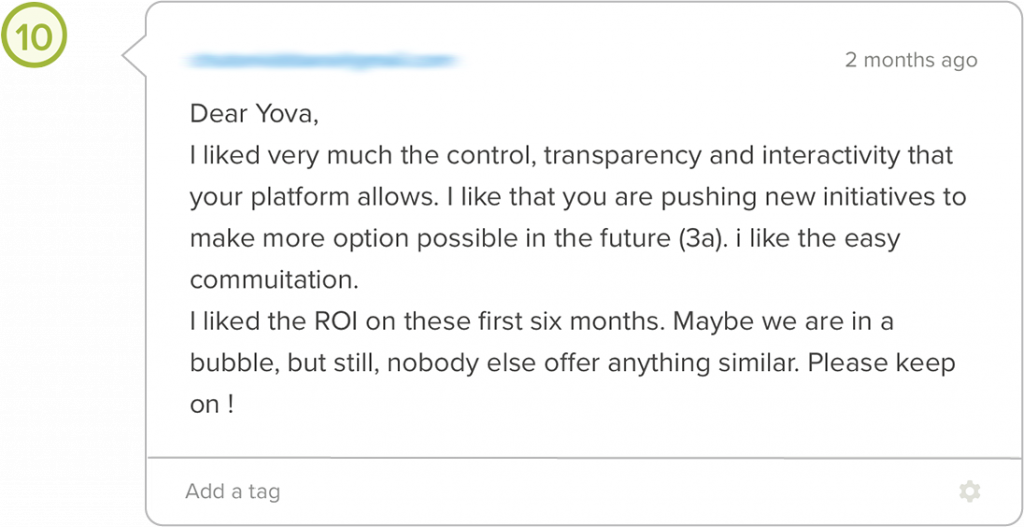

Ease of use

Even if a large group of our customers are tech-savvy, we’ve designed our product for people with all levels of computer skills. Customers find the sign-up and investment process to be streamlined and simple, making positive comments about the look and feel of the website.

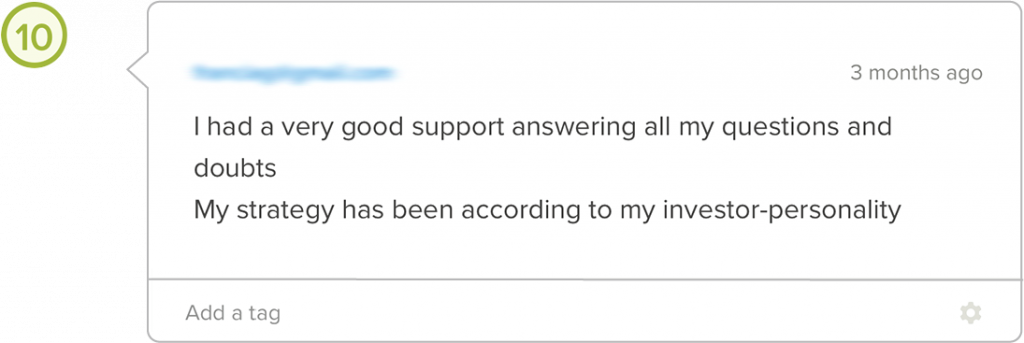

Customer service

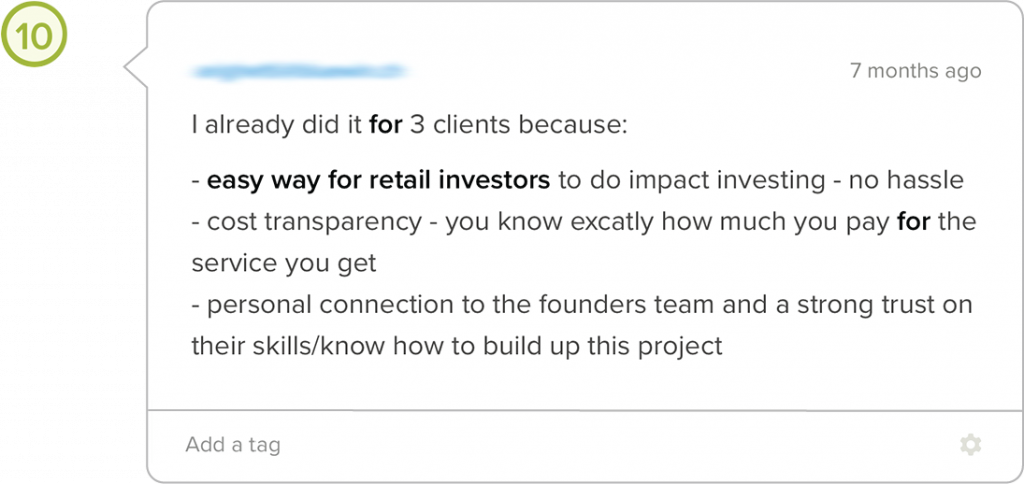

The approachability of our team is something that resonates with many people who use Inyova’s platform. Inyova reviews show that customers trust our team and are inspired by our vision to make impact investing accessible to everyone. Additionally, Inyova clients feel they are never left to figure the platform out on their own. Our friendly customer service team is on hand to guide every new user through each step of the process, from creating their impact investing strategy to interpreting their portfolio’s performance.

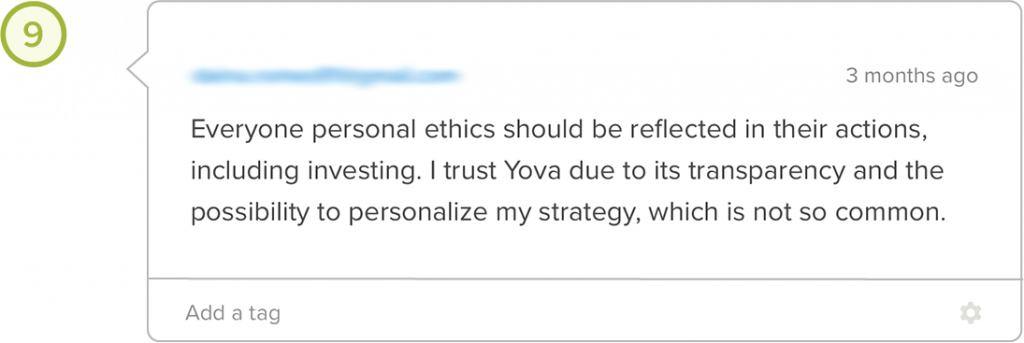

Mission for social change

Customers love how Inyova resonates with their values and empowers them to become changemakers in the world. Whether they are investing a high 6-figure sum or getting started with CHF 2,000, our customers appreciate being able to make a real difference for the planet.

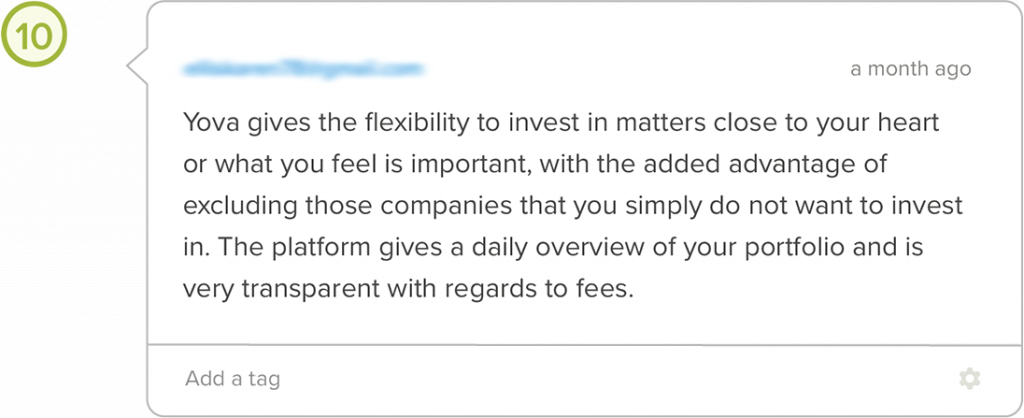

Transparency

Hate hidden fees and hidden agendas? So do we! Inyova customers tell us they appreciate how transparent we are about costs and how they can see which companies and themes they are investing in. With Inyova, there’s no more second-guessing about your impact; it’s easy to understand where your money goes and what activities it supports.

We’re delighted to see that customers are enjoying Inyova’s platform and find it to be intuitive, transparent, personal and aligned with their values. Equally, we’re happy to see people enjoy our customer service. But that’s no reason to stop here — we’re continuously striving to improve.

How are we improving the Inyova experience?

While nearly 9 out of 10 of our customers leave positive Inyova impact investing reviews, there are a couple of things they would like to see improved:

Lower fees

Occasionally, Inyova users tell us that they feel Inyova’s fees are too high and they would appreciate a cheaper option.

While there’s no immediate plan to reduce Inyova’s fees, we have done this before! In 2018, after reaching several major automation milestones, we were able to reduce our operating costs and pass these savings directly onto all our customers.

When comparing Inyova’s fees to other investment options, it’s also important to remember this:

- What makes Inyova unique and differentiates us from our competitors is that you directly own every stock in your portfolio. With most other providers, you invest in a generic fund, which means there are many complex layers between you and your money.

- With Inyova, you only ever pay this one simple fee. Every aspect of our service is contained within this. Meaning, there are no hidden fees or nasty surprises. With other providers, there are often additional fees in the fine print – entry and exit fees, performance fees, fund fees, and more. It can quickly add up!

More detailed information and daily reporting

A few users commented that they would like to see news about the companies in their portfolio, as well as information on new product releases, seminars, and patents. They also expressed a desire to have a way to track performance updates regularly and have more functionalities in the dashboard, as well as a display of live assets value.

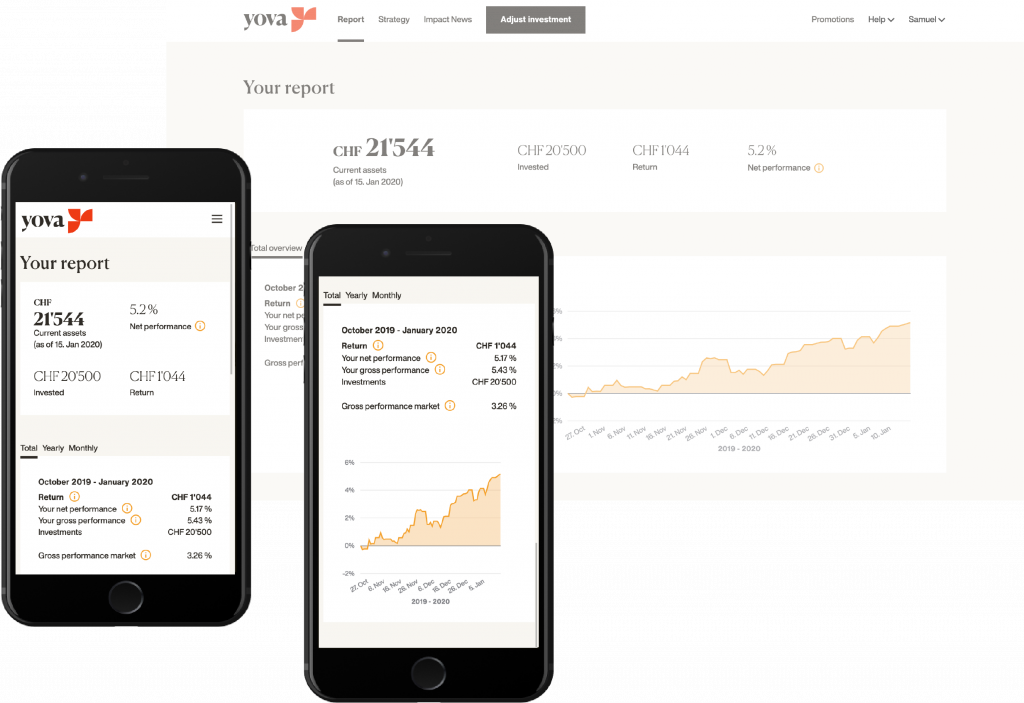

We appreciate how eager our customers are to learn and get more information on their investments! Our dashboard has undergone a huge evolution recently, and we are continuously improving it based on the features that our user base requests.

A major change that we introduced in late 2019 is daily updates to performance reports. This big change was driven by our users – initially, we really believed in monthly updates. Our thinking was this: Inyova investments are designed for long-term returns, and focusing on the daily movements of the market can only lead to short-term decision making (which rarely pays off in the long run!). However, the customer feedback was clear: people wanted to know what was happening with their portfolios.

Based on this feedback, we introduced daily reporting into each customer’s Inyova dashboard. And we must say, we really love how it turned out!

In 2019, we also introduced the “Impact News” section to the dashboards of invested customers. Here, they can stay up to date with the latest news related to companies and industries they are invested in.

Mobile app

A mobile Inyova app was another item high up in the wishlist of our customers. Users wanted to be able to access information on their investments on-the-go from their mobile devices. Since October 2020 this is finally possible: we launched the Inyova App for iOS and Android. If you are a customer, download it and try it out!

To increase the engagement of the shareholders, we are also working on an “active ownership”-model as an additional feature of the app. This will enable you to vote at general meetings of the companies in your portfolio – directly through the Inyova App.

We take each feedback very seriously and make sure to pay close attention to each comment. Inyova reviews like these are super valuable in helping us develop and shape our product.

In addition to the above-listed improvements, there are some more exciting changes that we have introduced in recent times, or are in the process of introducing:

Opening up the Inyova Roadmap for public voting

Since we want to keep up the momentum of engaging with our customers, we’ve introduced a system where you can vote on your favourite Inyova improvements. Whether you care about saving taxes through pillar 3a, starting a sustainable investment for your child, or using Inyova in French… you’re in luck! Keep sharing your opinion with us, and we promise to keep you posted on our progress.

Reducing the minimum deposit required to open an account

By reaching automation milestones, we were able to reduce the minimum deposit amount to CHF 2,000. For those who don’t have CHF 2,000 right away, it’s possible to start a savings plan with an initial deposit of CHF 500 and add funds over time – once the balance reaches CHF 2,000, we launch your investment. You can read more about our personalised approach here.

Hosting public events

Inyova reviews showed that customers wanted to meet us in person, so we started hosting open nights. Our first Open Night in May 2019 was so successful that it became a regular occurrence – sometimes even twice a month! In the second half of 2019, 300 people visited Inyova’s HQ over ten events. After successful events and workshops in Zurich, Bern, Lausanne, and Geneva, we’re ready to visit even more customers throughout Switzerland. If you want the Inyova team to host an event in your area, please let us know!

Expanding throughout Europe

One question that often comes up is, “When can people outside Switzerland sign up?” We finally have an answer: It’s happening this year! If all goes as planned, Inyova will be available throughout Europe before the end of 2020.

Introducing new products focused on gender equality

We are really proud to have developed a new way to assess companies in terms of gender equality. Now our customers can invest in companies that are closing the pay gap, developing female leaders, promoting women to the board of directors, and much more. Studies show that gender-balanced investments perform better than the market average, and gender balance can add CHF 12 trillion to the global economy by 2025, which represents a tremendous opportunity for impact.

Introducing new features

Over the past year, we’ve added new features to improve the user experience. Here are a few examples of our more significant milestones:

- We improved our approach to sustainability assessments, publishing a whitepaper to explain exactly how we select companies for your investment strategy.

- We introduced new impact topics, like plant-based food champions, the circular economy, and sustainable forestry.

For customers who want to create the most impact possible with their portfolio, we’re also working on an “impact-only” feature that allows customers to maximise their impact, instead of balancing it with the usual diversification criterion.

We’re continually looking for more ways to talk to our customers directly and learn first-hand what matters most to you when you think about the future of impact investing. Please keep sharing your visions and dreams with us, and we’ll try our best to make them a reality.

Let’s shape a better future together!

Backed by proprietary software, our Inyova engine designs your customised investment strategy to generate a positive impact on the environment and society – without compromise to your financial returns. We do this by:

- Considering fundamental questions, like what impact topics matter to you most and how much (or how little) risk you are comfortable taking. Whether you care about renewable energy, education, access to medicine or one of the other topics included in the Inyova “handprint”, we will identify companies that match your preferences and create an investment strategy tailored to you.

- Executing an investment optimised for long-term returns. All portfolios strive for market-level financial returns, while considering your personal risk preferences. Our financial approach is based on a Nobel-Prize winning theory that has been used by private banks for many decades.

- Constantly improving our offering. We stay on top of current issues, and regularly update our impact topics to reflect the changing world. For example, we recently added the topic of plant-based food, as well as the exclusion criteria of “no meat” (“no animal cruelty” has been an option at Inyova since the very beginning).

As highlighted in this article, 2019 was a big year for us. We partnered with a Swiss transaction bank, hit the milestone of 100 new customers in a month (and broke this record over and over again!), spoke at more than 45 events, received coverage from major news outlets like Tagesanzeiger, NZZ, Bilanz, Finanz and Wirtschaft, and on top of that, were named a Top 5 finalist in the Swiss Fintech Awards.

We’re planning on making the upcoming years even more memorable.

If you’ve journeyed with Inyova since the beginning, thank you so much for being here with us. We couldn’t have come this far without your support and commitment to social change. You inspire us every day with your passion for making a difference in the world and investing in companies aligned with your values.

If you are considering starting investing, we encourage you to learn more about our services. We’re growing very quickly, and our high level of service has resulted in increased trust with customers: the money we managed increased by 400% in the final quarter of 2019 alone!

More importantly, our customers come back for more — the number of people who re-invest with Inyova has more than doubled in the last six months. As a team, Inyova reviews and ratings make us very proud – they show us that customers feel more empowered than ever to invest their money into the companies that are solving the biggest issues of our time.

With Inyova, there are no hidden fees, and you can invest even small amounts. Collaborate with us to create your free personalised impact investing strategy today, and let’s explore the difference we can make for the future together.

Advertising notice: The information and evaluations presented here are an advertising announcement which has not been prepared in accordance with legal provisions promoting the independence of financial analyses and is not subject to any prohibition of trading following the dissemination of financial analyses. The acquisition of this investment involves considerable risks and may lead to the complete loss of the invested assets. Inyova receives an all-inclusive fee of 0.9 - 1.2 & p.a. for its services, depending on the amount of assets under management. The exact calculation can be found at www.inyova.de/en/fees.

Risk notice: All information is only intended to support your independent investment decision and does not represent a recommendation by Inyova. The product information and calculation examples presented do not claim to be complete or correct. Only the specifications in the asset management contract incl. the further legal documents, which are made available to customers of Inyova via the complete customer documentation, are authoritative. Please read the asset management contract and the other client documents carefully before making an investment decision. The following applies to all shares and ETFs: Past performance is no guarantee of future performance. Information on past performance does not permit forecasts for the future. Investments in securities include the risk of a loss in value. Other securities services may achieve different results. The results for individually managed portfolios as well as the different time full stops may differ due to market conditions, different entry times, different portfolio sizes, individual restrictions and the respective composition of the portfolio.

Disclaimer: Past performance of financial markets and instruments is never an indicator of future performance. The statements or information contained in this document do not constitute a recommendation, offer, or solicitation to buy or sell any security or financial instrument. Inyova GmbH assumes no liability whatsoever with regard to the reliability and completeness of the information contained in this article. Liability claims regarding damage caused by the use of any information provided, including any kind of information which is incomplete or incorrect, will therefore be rejected. Furthermore, the statements contained in this document reflect an assessment at the time of publication and are subject to change. References and links to third party websites are outside the responsibility of Inyova GmbH. Any responsibility for such websites is declined.

EU Sustainable Finance Regulation: the terms and categories from this post do not correspond to the terms and categories of the EU Sustainable Finance Regulation. You can find the disclosures and explanations required under the EU Sustainable Finance Regulation at https://inyovagmbhpro.wpenginepowered.com/en/sustainable-finance-disclosure-regulation..